Toyota is increasing hybrid production in the United States as electric vehicle growth moderates and consumer demand tilts toward more flexible electrification options. The shift reinforces Toyota’s long held strategy of prioritizing hybrids as a core pathway to emissions reduction.

U.S. assembly plants are adjusting production mix to allocate greater capacity to hybrid variants of popular sedans, SUVs, and crossovers. Executives say the decision reflects sustained retail demand and faster inventory turnover compared with fully electric models in several regions.

Hybrid vehicles have consistently outperformed broader electrified segments in terms of take rates. Consumers are drawn to improved fuel economy without the need for charging access or significant changes to driving habits.

Toyota’s incremental approach to electrification contrasts with more aggressive EV expansion strategies pursued by some competitors. Rather than pushing rapid full electric scaling, the company has emphasized multi pathway powertrain development, including hybrids, plug in hybrids, and hydrogen research.

Dealers report that hybrid models are often sold before reaching full lot capacity. Inventory days supply for hybrids remains tighter than for certain EV models, encouraging manufacturers to rebalance output accordingly.

Production adjustments are also influenced by affordability considerations. Hybrids generally carry lower starting prices than comparable EVs and qualify for a broader range of financing programs.

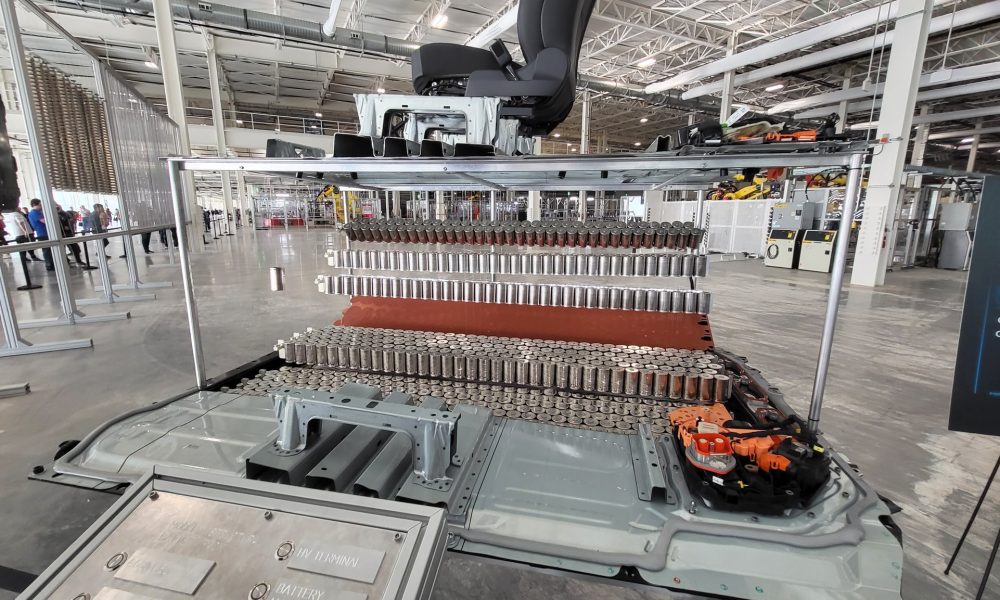

Battery supply allocation plays a role as well. Prioritizing hybrid production allows Toyota to distribute battery resources across a larger number of vehicles, maximizing fleet wide efficiency gains.

Industry analysts view the move as pragmatic. While EV adoption continues, growth rates have normalized in 2026 compared with earlier expansion forecasts. Hybrids offer a stable volume base while infrastructure and consumer readiness evolve.

The increased hybrid output does not signal a retreat from EV development. Toyota continues to invest in dedicated electric platforms and battery research. However, near term production planning reflects real world demand patterns.

Regional sales data indicates particularly strong hybrid performance in suburban and rural markets, where charging infrastructure is less dense.

Environmental impact considerations remain central to the strategy. Toyota argues that expanding hybrid penetration across high volume models can reduce overall fleet emissions more quickly than limited EV adoption in select segments.

Investors have generally interpreted the production shift as margin protective. Hybrids often deliver steadier profitability due to mature supply chains and predictable demand.

As 2026 progresses, Toyota’s recalibrated output mix underscores a broader industry theme. Electrification is advancing, but along a varied timeline shaped by consumer behavior, infrastructure readiness, and cost discipline.

In balancing hybrid expansion with continued EV investment, Toyota is positioning itself for adaptability rather than rapid transformation.