Auto industry restructuring is accelerating in 2026 as major OEMs streamline North American operations to protect margins and align production with more measured demand forecasts. What began as targeted cost cutting has evolved into broader structural adjustments across manufacturing, engineering, and corporate functions.

Manufacturers including General Motors, Ford, and Stellantis have all initiated operational reviews aimed at improving efficiency and reducing overhead. The actions range from shift reductions at assembly plants to consolidation of product development teams.

The restructuring reflects a normalization of the market after years of volatility. During supply constrained periods, elevated pricing masked cost inefficiencies. As incentives return and demand growth moderates, automakers are under renewed pressure to maintain profitability through disciplined cost management.

Plant utilization has become a focal point. Facilities operating below optimal capacity create margin drag, prompting OEMs to adjust production schedules, combine lines, or temporarily idle shifts. These moves are designed to prevent excess inventory and reduce fixed cost exposure.

Corporate restructuring is also underway. Some manufacturers are simplifying management layers, integrating EV and internal combustion operations, and centralizing software development to eliminate duplication. The goal is to create leaner organizations capable of adapting quickly to shifting consumer demand.

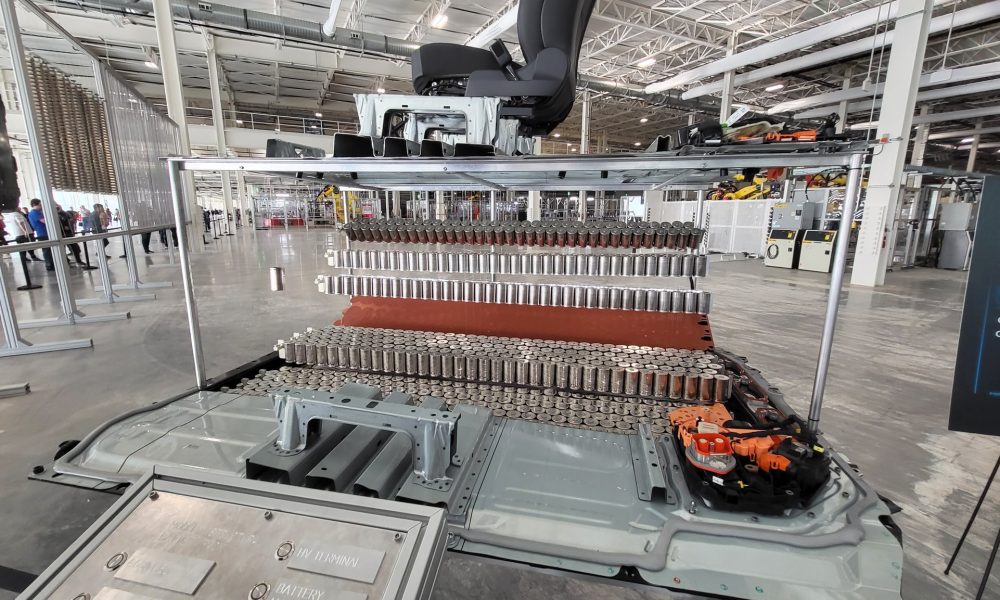

Electrification strategy plays a role in the restructuring. As EV adoption progresses unevenly, OEMs are recalibrating investment pacing and reallocating resources toward hybrids and efficient gas models in the near term. This flexibility requires operational adjustments across engineering and manufacturing divisions.

Supplier networks are feeling downstream effects. Reduced production targets and platform consolidation can impact order volumes and contract terms. Tier 1 suppliers are simultaneously undergoing their own restructuring efforts to preserve margins.

Labor considerations remain sensitive. While large scale permanent closures are limited, shift adjustments and workforce realignments are becoming more common. Automakers are attempting to balance cost discipline with long term capacity preservation.

Investors have generally responded favorably to restructuring announcements, viewing them as proactive steps to safeguard earnings. In a margin constrained environment, decisive cost action is often rewarded by financial markets.

Industry analysts describe the current phase as strategic optimization rather than crisis driven downsizing. OEMs are not retreating from long term investments in electrification, software, or advanced manufacturing. Instead, they are recalibrating the pace and scale of deployment.

Regional dynamics are influencing decisions as well. North American operations must compete internally for capital allocation against global divisions. Demonstrating operational efficiency strengthens the case for future product investment.

As 2026 progresses, restructuring efforts are expected to continue selectively across the industry. The focus is shifting from expansion to optimization, where efficiency and agility define competitive advantage.

In a market no longer buoyed by extraordinary pricing power, streamlining operations is emerging as a defining theme. For OEMs navigating uneven demand and rising development costs, restructuring is becoming less optional and more foundational.