The Chicago Auto Show 2026 edition underscored a clear shift in industry priorities, with automakers emphasizing hybrid powertrains and more affordable model launches rather than high priced flagship EV debuts.

Traditionally known for major truck and SUV reveals, this year’s show reflected a recalibrated market environment. Manufacturers focused on vehicles positioned for volume and accessibility, aligning product strategy with evolving consumer demand.

Hybrid vehicles featured prominently across multiple booths. Automakers highlighted fuel efficiency gains, improved battery integration, and expanded availability across mainstream segments. Executives framed hybrids as practical solutions for buyers seeking lower fuel costs without committing to full electrification.

Affordability was another central theme. Several brands introduced entry level trims, refreshed compact models, and simplified configurations aimed at reducing starting prices. In a market shaped by elevated interest rates, automakers appeared keenly aware that monthly payment sensitivity remains a defining factor.

Companies such as Toyota and Hyundai showcased hybrid expansions within popular SUV lineups, signaling confidence in steady hybrid demand growth. Meanwhile, domestic manufacturers emphasized value focused updates to core truck and crossover offerings.

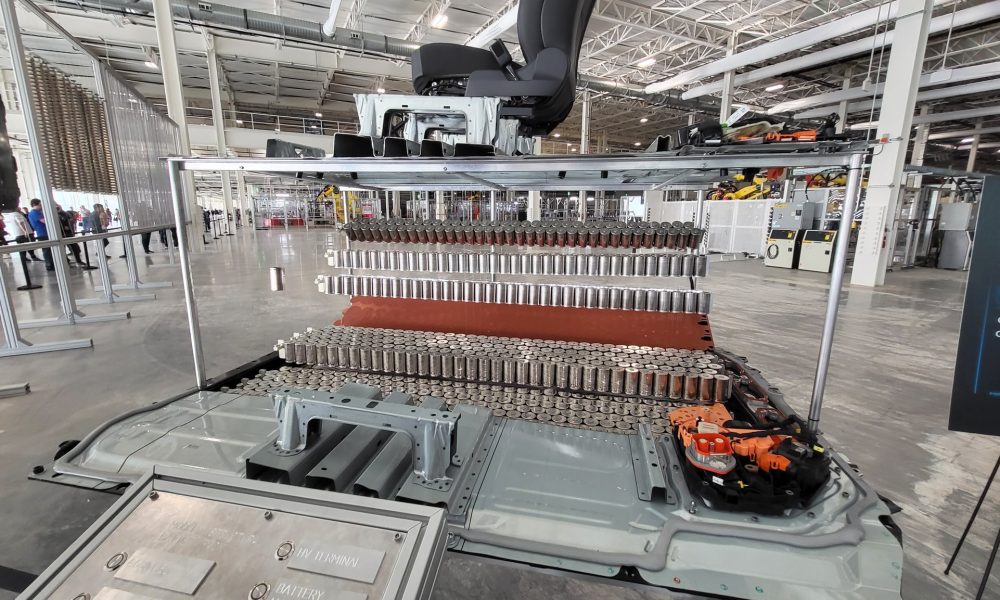

Fully electric vehicles were present but less dominant than in prior years. Rather than unveiling radical new EV platforms, brands concentrated on incremental improvements, software updates, and charging ecosystem partnerships.

Dealer sentiment at the show reflected cautious optimism. Retailers reported steady showroom traffic but noted that customers are prioritizing practicality over novelty. Vehicles offering clear cost advantages and everyday usability attracted the most attention.

Industry analysts interpreted the shift as evidence of normalization. The rapid electrification messaging that defined earlier shows has given way to a more balanced narrative centered on choice and gradual transition.

Supplier exhibits mirrored this trend. Displays highlighted efficiency technologies, lightweight materials, and hybrid component integration rather than exclusively EV focused innovations.

The Chicago Auto Show has historically served as a barometer of U.S. consumer taste. This year’s emphasis on hybrids and affordability suggests automakers are adapting to a market where growth depends on accessibility and cost discipline.

While innovation remains important, the tone was pragmatic. Manufacturers are pacing electrification while ensuring that core, high volume segments remain competitive.

As 2026 progresses, the themes showcased in Chicago are likely to carry through upcoming product cycles. Hybrid expansion and value oriented launches appear positioned to anchor the next phase of industry strategy.

In a year marked by cautious growth expectations, the Chicago Auto Show highlighted an industry aligning product plans with consumer realities rather than aspirational targets.