Commercial vehicle orders are showing resilience in early 2026 even as broader retail auto demand softens. While passenger vehicle sales face affordability pressures and cautious consumer sentiment, fleet driven segments such as medium duty trucks and vans are maintaining steadier momentum.

Preliminary industry data indicates that order volumes for commercial trucks and delivery vehicles have held relatively stable compared with late 2025 levels. Analysts attribute the resilience to sustained demand in logistics, construction, and municipal sectors, where replacement cycles and operational necessity outweigh short term economic hesitation.

Manufacturers such as Ford and General Motors continue to report healthy interest in commercial variants of their truck and van lineups. Fleet buyers are prioritizing reliability, uptime, and total cost of ownership rather than discretionary upgrades.

E commerce and last mile delivery remain structural drivers. Despite slower consumer spending growth, logistics networks require consistent vehicle replenishment to maintain service standards. Fleet operators are replacing aging vehicles to reduce maintenance costs and avoid downtime.

Municipal and public sector procurement has also contributed to order stability. Budget allocations finalized in previous fiscal cycles are translating into vehicle purchases in early 2026, providing a buffer against private sector variability.

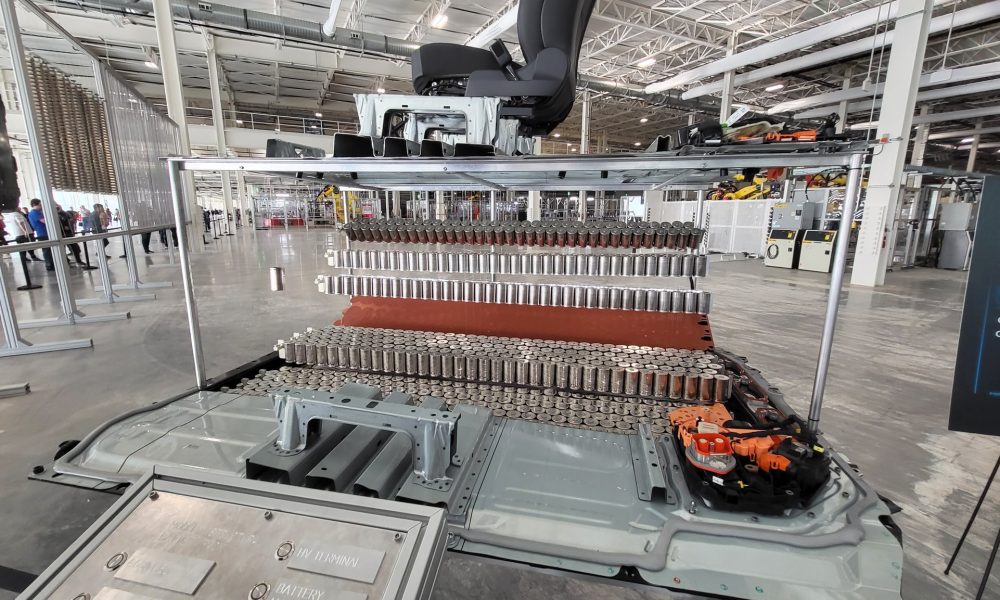

Electrification within commercial segments is advancing more cautiously. Hybrid and alternative fuel options are gaining incremental traction, particularly where fuel savings can be measured clearly. However, many fleet operators continue to evaluate full electric adoption carefully due to infrastructure and charging constraints.

Financing conditions affect fleets differently than retail buyers. Commercial purchasers often rely on structured financing agreements, leasing programs, or bulk procurement arrangements that reduce sensitivity to short term interest rate fluctuations.

Supply chain conditions have improved compared with prior years, allowing manufacturers to fulfill orders more predictably. Stable parts availability supports production continuity and enhances confidence among fleet buyers placing forward orders.

Industry analysts suggest that commercial resilience reflects the essential nature of these vehicles. Unlike consumer purchases, which can be delayed, fleet vehicles are tied directly to revenue generation and operational capability.

However, caution remains. If broader economic softness deepens, order growth could moderate later in the year. Fleet operators are monitoring freight volumes, infrastructure spending, and construction activity as leading indicators.

For now, the steadiness in commercial vehicle orders provides a counterbalance to softer retail conditions. It underscores the diversified demand structure within the automotive sector.

As 2026 progresses, commercial segments may continue to offer relative stability even if passenger vehicle growth remains uneven. In a market defined by selective strength, commercial vehicles are proving to be one of the more resilient pillars.