Ford and Geely are reportedly exploring potential manufacturing and technology partnership talks in 2026, signaling a pragmatic shift in how global automakers approach scale, cost control, and electrification strategy.

While no formal agreement has been announced, discussions are understood to involve collaboration in selected markets, platform sharing, and possible technology exchange. The talks reflect mounting pressure across the industry to reduce capital intensity while accelerating innovation in electrification and software.

Ford has been recalibrating its global strategy as EV demand growth moderates and profitability becomes a primary focus. Geely, meanwhile, has expanded aggressively across Europe and Asia, building a portfolio that includes both mass market and premium brands. A partnership between the two would represent a strategic alignment rather than a merger, aimed at leveraging complementary strengths.

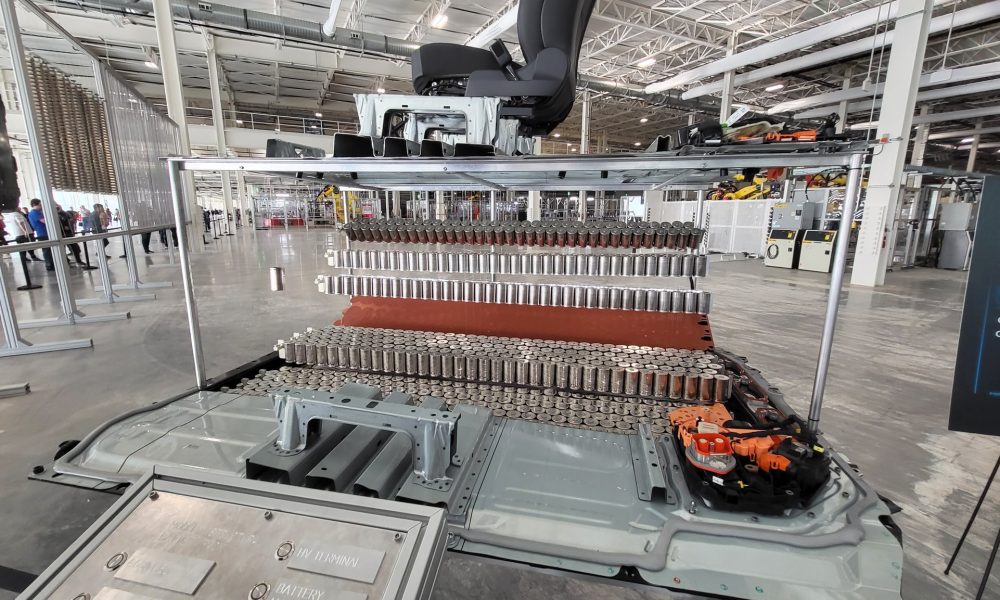

Manufacturing efficiency appears to be a key area of interest. Joint production in select regions could allow both companies to optimize plant utilization, lower per unit costs, and reduce duplication in future vehicle platforms. As global demand becomes more uneven, shared capacity can provide flexibility without requiring new large scale investments.

Technology cooperation is another potential pillar. Software development costs continue to rise industry wide, particularly in advanced driver assistance systems, connectivity, and electrified powertrains. Shared research and development could help both companies manage costs while accelerating deployment timelines.

Supply chain resilience may also factor into discussions. Battery sourcing, semiconductor integration, and component localization have become strategic priorities. Collaboration could improve negotiating leverage with suppliers and reduce exposure to regional disruptions.

Geely has demonstrated experience in international partnerships, notably through its ownership stakes and platform collaborations across multiple brands. Ford brings a strong North American presence and established commercial vehicle expertise. Analysts suggest these strengths could align in specific segments such as compact EVs, hybrids, or commercial platforms.

However, regulatory scrutiny and geopolitical considerations could influence the scope of any partnership. Cross border automotive cooperation, particularly involving technology and data systems, faces increasing review in both U.S. and global markets. Any agreement would likely be structured carefully to address compliance and security concerns.

Investors are watching the talks as a sign of broader industry evolution. The era of automakers developing every major technology independently is fading. Capital discipline, platform sharing, and targeted alliances are becoming standard tools to preserve margins.

Dealers and suppliers would likely experience downstream effects if cooperation advances. Shared platforms may standardize components, streamline logistics, and reduce complexity across regions. At the same time, suppliers tied to proprietary systems could face adjustment pressure.

Neither company has publicly confirmed detailed terms, and discussions may remain exploratory. Still, the fact that two large global manufacturers are evaluating collaboration underscores the current industry climate. Scale alone is no longer enough. Strategic alignment is becoming essential.

If talks progress, the partnership could represent one of the more significant cross market automotive collaborations of the year. In a market defined by cautious growth and rising development costs, shared manufacturing and technology investment may prove to be a logical next step.