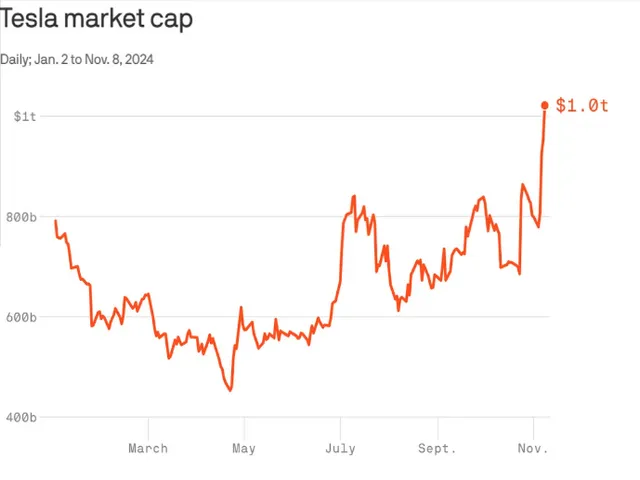

Tesla has once again captured the attention of the stock market, reaching a major milestone with its market cap surging past the $1 trillion mark. This achievement places Tesla among a select few companies worldwide that have managed to surpass this valuation, highlighting the electric vehicle (EV) giant‘s significant influence in the tech and automotive sectors.

Not only has Tesla’s stock price seen a remarkable uptick recently, but this surge has also had a notable effect on CEO Elon Musk’s net worth, making him the wealthiest individual by a large margin.

The upward trend of Tesla’s shares is especially interesting given recent political shifts, with many investors speculating how these changes could impact Tesla’s growth trajectory. This article dives into the implications of Tesla’s recent accomplishments, exploring what the $1 trillion market cap could mean for the company and the broader EV industry.

We also examine the influence of political factors, such as Donald Trump’s recent presidential win, and how Musk’s alliance with Trump may further shape Tesla’s future.

From competitive advantages to potential regulatory changes, each factor adds layers to the significance of this milestone. Read on to get a detailed look at Tesla’s soaring market cap and what it means for both the company and the rapidly evolving EV landscape.

Tesla Hits $1 Trillion Market Cap: What It Means for the EV Industry

Tesla’s market cap reaching $1 trillion is a monumental achievement, placing it in the elite club of only a few U.S. companies that have crossed this milestone. This accomplishment speaks volumes about Tesla’s dominance and influence in the EV industry.

With this valuation, Tesla stands out not just as an automaker but as a tech powerhouse with significant market share and unmatched brand recognition. The $1 trillion mark underscores the rapid growth of the EV industry, driven by increasing demand for sustainable transportation solutions and innovation in electric and autonomous driving technologies.

For other EV companies, Tesla’s market valuation serves as both an inspiration and a challenge, pushing competitors to match or exceed its innovation and production capabilities. The surge in Tesla’s stock price reflects optimism among investors, especially amid the growing possibility of reduced regulations under the new political administration.

Analysts suggest that this achievement could pave the way for accelerated advancements in EV technologies, particularly as Tesla leverages its massive scale and resources to develop new features, including its autonomous driving technology.

As Tesla continues to lead the charge, its dominance could set a higher benchmark for both established and emerging players in the EV industry. The ripple effects of Tesla’s success could encourage further investment in clean energy and technology, benefiting the industry as a whole.

Elon Musk’s Net Worth Soars to $300 Billion After Trump Win

Elon Musk’s net worth surged to $300 billion, driven largely by Tesla’s recent stock rally. This climb represents Musk’s richest standing in over two years, a gain of about $13 billion just on Friday.

Investors’ optimism following Donald Trump’s presidential win has supported this upward momentum, with Musk emerging as one of Trump’s top business allies during the campaign. Musk’s 13% stake in Tesla, valued at roughly $130 billion, forms a significant portion of his wealth.

His holdings, pending a Delaware court decision, could even increase, as a 9% bonus in stock options is under consideration. This substantial wealth hike makes Musk $70 billion wealthier than the next-richest person, Larry Ellison of Oracle, and positions him among the wealthiest globally.

The Tesla CEO’s involvement in Trump’s campaign, where he reportedly contributed over $130 million, could play a strategic role for Tesla’s future. Trump has spoken favorably of Musk and hinted at potential roles in his administration, further cementing the partnership.

In particular, Musk’s strong support for Trump’s policies may lead to regulatory changes that benefit Tesla, particularly in self-driving vehicle approvals and China tariffs.

With Musk’s increased wealth and potential political influence, Tesla’s future could see fewer regulatory challenges, especially if federal-level guidelines replace state-based ones for autonomous driving tech.

Tesla’s Trillion-Dollar Milestone: Breaking Down Key Factors

Tesla’s market cap crossed the $1 trillion mark once again, joining an elite group of tech giants like Apple, Microsoft, and Amazon. Tesla’s stock rose 8% on Friday, closing at $321 per share, marking a three-day rally of about 29% following Trump’s election.

This surge is a reversal of Tesla’s early 2024 performance, which saw a significant downturn. The latest rally also means Tesla’s stock has climbed over 30% year to date, with shares showing renewed momentum since the third-quarter earnings report, which exceeded analysts’ predictions.

With strong revenue of $25.18 billion and net income of $2.17 billion last quarter, Tesla appears well-positioned as the market shows confidence in its future growth. Several factors contribute to Tesla’s valuation boost, including the possibility of fewer EV regulations under Trump.

Analysts, including Wedbush’s Dan Ives, believe that Trump’s return could help Tesla avoid competing with cheaper Chinese EVs by enforcing higher import tariffs. Moreover, federal-level support could accelerate the approval process for Tesla’s autonomous technology, which Musk has long touted as a key to future growth.

However, as regulatory benefits may be tempered by potential cuts to the federal EV tax credit, it remains uncertain how significant the financial boost will be for Tesla in the coming years.

What’s Next for Tesla and Elon Musk’s Empire? Future Insights

As Tesla moves past the $1 trillion market cap, Elon Musk’s empire faces several growth opportunities and challenges. Musk has ambitious plans, including expanding autonomous driving technology and launching more affordable Tesla models to boost market share.

The company aims for a 20-30% growth in vehicle production next year, supported by Musk’s belief in future “cost-effective” electric vehicles and advancements in self-driving capabilities.

Regulatory approval for fully autonomous cars remains a major hurdle in the U.S., with Musk advocating for a centralized federal system rather than navigating varied state regulations. Success in this area could provide Tesla a significant advantage over competitors like Waymo, which is already operating autonomous taxis in select cities.

In addition, potential tariffs on Chinese EV imports under a Trump administration could limit competition, benefiting Tesla’s standing in the U.S. market. Musk’s broader vision for Tesla includes strengthening its artificial intelligence capabilities and branching into energy solutions.

While Tesla continues to pursue AI for self-driving, the journey is complex, with many technical and regulatory challenges ahead. As demand for green energy grows, Tesla is positioned to lead in renewable energy storage and solar power.

However, it remains uncertain how a Trump-led administration, with its mixed stance on EVs, might influence federal support for green energy initiatives. For now, Tesla’s growth largely relies on innovations in AI, a stable supply chain, and potential policy shifts that could redefine the EV landscape.

How Investors Reacted to Tesla’s Market Cap Breaking $1 Trillion

Tesla’s surge past the $1 trillion mark has spurred strong investor enthusiasm, driving an 8% stock increase to $321.22, with a 29% gain over the past week. This rally has been fueled by speculation that a Trump presidency could benefit Tesla through potential regulatory ease, reduced EV credits, and higher tariffs on Chinese EV imports.

Investors have reacted positively, viewing Musk’s influence and close ties with the Trump administration as a potential advantage for Tesla’s continued U.S. growth. Options trading in Tesla stock reached a record 4.7 million contracts on Friday, indicating bullish confidence in the stock’s upward trajectory.

Notably, some analysts like Dan Ives from Wedbush see Tesla’s scale as providing a “clear competitive advantage” in a subsidy-free environment. However, Wall Street experts are mixed on whether these gains are sustainable, with some cautioning that Tesla’s current valuation may already account for a “dream premium.”

Tesla trades at 102 times its projected earnings, a figure much higher than competitors like Nvidia, which trades at around 39 times earnings. Despite these valuation concerns, many Tesla backers believe the stock has room to grow, as evidenced by the surge in call option purchases.

The excitement around Musk’s leadership and potential regulatory changes has driven an upswing in Tesla’s stock, but the real impact of these factors on Tesla’s long-term success remains to be seen.

Final Words

Tesla’s remarkable market journey reflects the electric vehicle maker’s ever-evolving position in the global automotive landscape, achieving the rare feat of a $1 trillion valuation.

CEO Elon Musk’s leadership and support for autonomous technology, combined with a potentially favorable political climate, are helping bolster Tesla’s position as a front-runner in the EV industry.

However, the high valuation has raised questions about whether Tesla’s stock can sustain this momentum in the face of regulatory and competitive challenges. The company’s ambitious goals, including expanding production and enhancing its AI capabilities, suggest that it’s well-positioned for continued growth.

Analysts remain cautiously optimistic about Tesla’s future, as policy changes, technological breakthroughs, and market dynamics continue to influence its valuation.

As always, stay tuned to Auto Freak for the latest news, analysis, and insights on Tesla’s journey and other automotive industry developments.