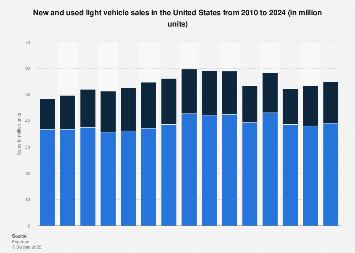

The U.S. auto market closed 2025 on a strong note, with new-vehicle sales projected to reach 16.3 million units, marking the best annual performance since 2019, even as momentum softened slightly in the final quarter of the year.

According to industry estimates, December 2025 sales are expected to total around 1.46 million units, marginally lower than December last year but higher than November’s volumes. The data highlights a resilient auto sector supported by incentives, pent-up consumer demand, and strong performance in trucks, SUVs, and hybrid vehicles.

Market Leaders Dominate 2025 Sales

General Motors emerged as the clear market leader in 2025, selling approximately 2.83 million vehicles and capturing a 17.3% market share, up from 16.8% in 2024. Strong demand for pickups and SUVs, combined with aggressive year-end incentives, helped GM retain its top position.

Toyota followed closely with 2.52 million vehicles sold, securing a 15.5% share of the U.S. market. Toyota continued to benefit from steady demand for fuel-efficient and hybrid models.

Ford and Hyundai also delivered solid results, with Hyundai posting record hybrid sales, even as demand for fully electric vehicles showed signs of cooling.

Q4 Slowdown, But Year Remains Robust

While overall annual performance was strong, the fourth quarter saw a modest slowdown. November 2025 sales fell to 1.27 million units, down 6.7% year-on-year, reflecting tighter consumer spending and softer EV demand.

The seasonally adjusted annual rate (SAAR) for December is estimated at 15.9 million units, improving from November’s 15.6 million but remaining below December 2024’s 16.8 million pace.

Despite this, analysts note that incentives, dealership traffic driven by pricing concerns, and delayed purchases from earlier in the year helped stabilize volumes toward year-end.

Shifting Consumer Preferences Shape the Market

One of the most notable trends in 2025 was the slower-than-expected growth in EV sales. Automakers increasingly pivoted toward hybrids and conventional internal combustion vehicles, aligning with consumer preferences for affordability, range confidence, and lower ownership costs.

Additionally, tariff uncertainty and pricing fears earlier in the year pushed many buyers to dealerships sooner than planned, helping lift overall annual sales figures.

Outlook

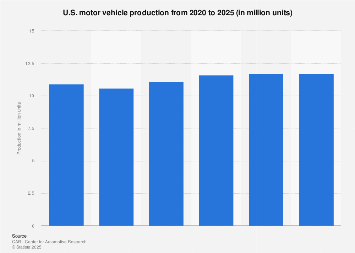

With 2025 delivering the strongest U.S. auto sales performance since 2019, the industry enters 2026 with renewed confidence. However, automakers are expected to closely monitor EV demand, pricing pressures, and economic conditions as they balance incentives, production strategies, and evolving consumer expectations.