Global trade policy shifts are creating new export and tariff risks for U.S. automakers as geopolitical tensions and economic realignments reshape cross border commerce. For manufacturers that depend on integrated supply chains and overseas sales, evolving trade frameworks are emerging as a significant strategic variable in 2026.

U.S. automakers such as Ford and General Motors export vehicles and components to multiple global markets while also importing parts from international suppliers. Changes in tariff structures or trade agreements can quickly alter cost calculations and pricing competitiveness.

Recent policy discussions have focused on strengthening domestic manufacturing while reassessing trade relationships with key automotive regions. Adjustments to tariff rates or content rules could increase input costs for vehicles assembled in North America, particularly those reliant on globally sourced components.

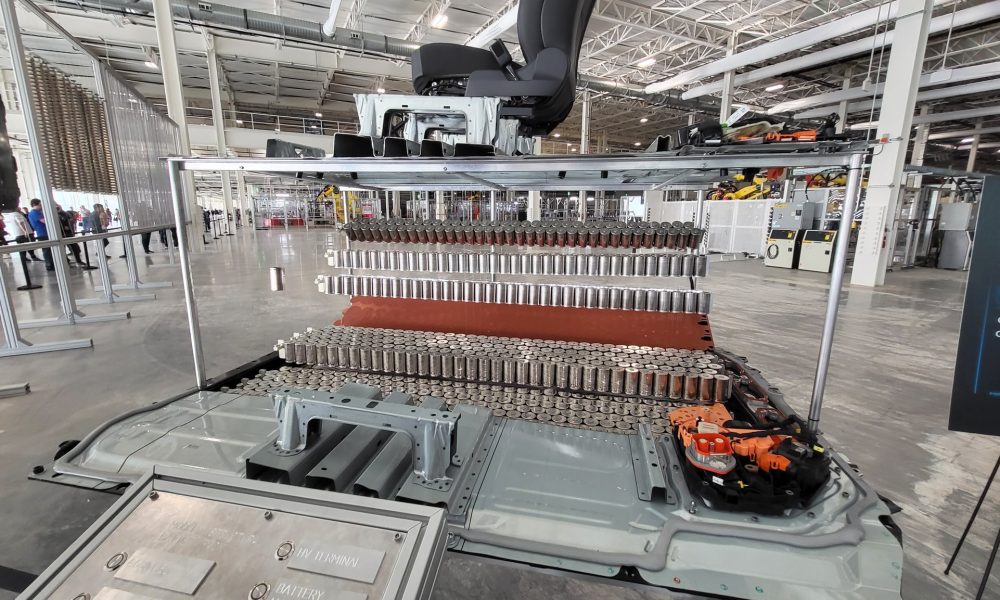

Electric vehicles add another layer of complexity. Battery materials, cells, and electronics often involve multi country supply chains. Trade restrictions or tariff adjustments affecting these inputs could influence EV pricing and profitability more significantly than traditional internal combustion models.

Export exposure varies by manufacturer. Some brands rely heavily on overseas markets for high margin SUVs and trucks produced in U.S. plants. If tariffs increase in destination markets, those vehicles could face pricing disadvantages relative to locally produced competitors.

Supply chain diversification efforts are underway, but reconfiguring global sourcing networks takes time and capital. Automakers are balancing resilience against cost efficiency as they evaluate long term manufacturing footprints.

Trade policy uncertainty can also influence investment decisions. Manufacturers considering new plant expansions or product allocations must factor in potential tariff exposure over a vehicle’s lifecycle, which often spans several years.

Industry associations are advocating for stability and predictability in trade policy, emphasizing that abrupt shifts can disrupt planning and raise consumer prices. At the same time, policymakers argue that strategic trade measures may strengthen domestic capacity in critical industries.

Currency fluctuations further compound risk. Changes in trade policy can influence exchange rates, affecting both export competitiveness and the cost of imported parts.

Investors are increasingly attentive to trade exposure in earnings forecasts. Companies with diversified production bases may be better positioned to absorb shocks, while those concentrated in specific regions could face higher volatility.

Despite these challenges, global markets remain essential to U.S. automakers. Export sales contribute meaningfully to revenue, and international collaboration remains central to technology development.

As 2026 unfolds, trade policy will likely remain fluid. Automakers are preparing contingency plans, modeling tariff scenarios, and strengthening domestic supplier relationships to mitigate potential disruption.

In a globally integrated industry, trade shifts do not simply influence policy discussions. They shape production decisions, pricing strategy, and long term competitiveness. For U.S. automakers, navigating export and tariff risk is becoming an ongoing strategic imperative rather than an occasional concern.