2019 has been a rather forgettable season for the Indian Automobile business as well as the reasons are many. Increase in vehicle prices, A protracted economic downturn, revised load norms for CVs that reduced subdued consumer opinion, the IL&FS catastrophe which influenced lending in India, the shift in BS-IV and M&HCV buying.

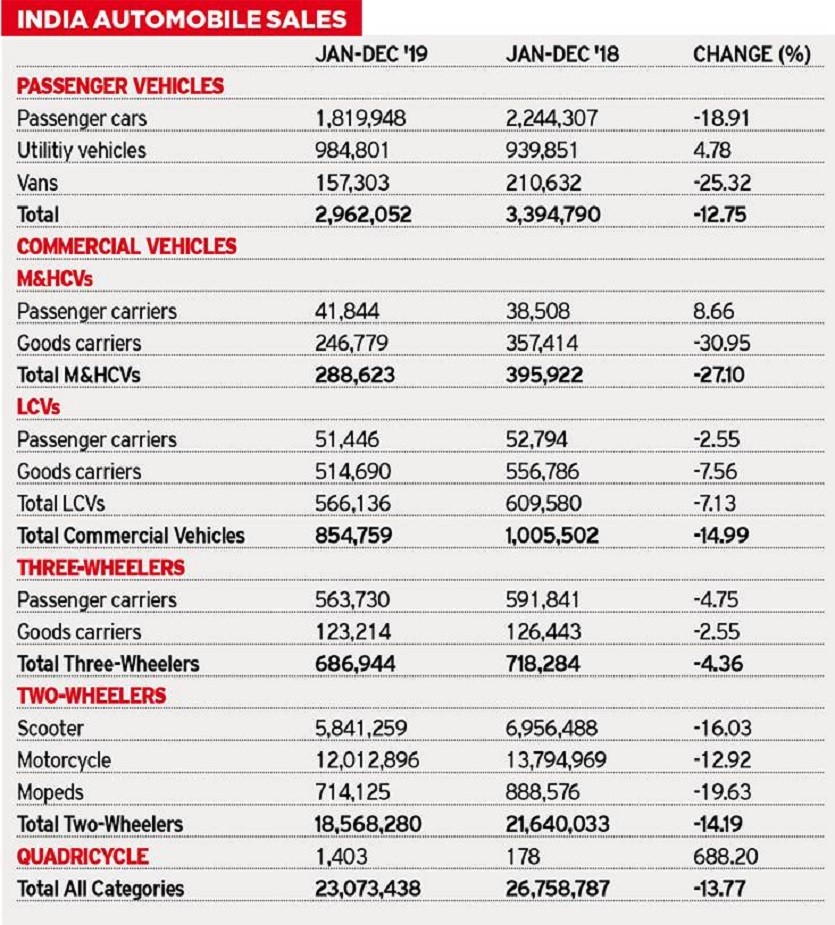

Apex industry human Society of Indian Automobile Manufacturers (SIAM) Yesterday, released the CY2019 sales numbers. Take a close look at the revenue table below and you also discover that all four vehicle segments are compared to the business’s operation in 2018. Overall automobile sales in 2019 declined 13.77 percent to 23,073,438 units (CY2018: 26,758,787). This is, based on SIAM, the industry’s worst performance in nearly two years.

The passenger car (PV) section continued to be struck hard, leading To 12.75 percent deterrent into 2,962,052 units (3,394,790); CVs declined 15 Percent to 854,759 units (1,005,502); three-wheelers fared the best with 4.36 percentage de-growth to clock 686,944 components (718,284) while Two-wheelers continued to observe a downtrend To 18,568,280 units (21,640,033).

While Utility Vehicles, on robust with 4.78 percent growth and riding Decelerating GDP growth and Requirement for SUVs, have done well, level growth in crop production, drop in consumer goods sales impacted the CV segment. Two-wheelers, which saw a price increase due to weak sentiment that was rural in addition to ABS / CBS execution, was hit too.

According to Rajan Wadhera, presidentSIAM,” While things are The rate of expansion is not really steep. It may take a bit longer to come out of this recessionary phase. Among the reasons for expansion in UVs is the launching of new versions. In the past 5-6 years, in PVs, UV models’ number has grown to coincide with the number of passenger car models. At the moment, UVs has grown to 53 models to where auto models have attained, after viewing a decline.”

“In the two-wheeler segment, There’s an expectation that after The reduction of rabi, the Kharif crop will be great this year. But, we are not entirely from the challenges. Whatever expansion has arrived, has been in certain pockets.” “While the government is focusing on the revival of the car sector in the form of a number of initiatives taken like depreciation benefits, corporate tax decrease and rise to infrastructure projects which have increased need for tippers and products carriers, the revised GDP growth rate nowhere augurs well for the industry. Moreover, our demand for a GST cut has not been fulfilled, along with the BS-IV into BS-VI transition continues to remain among the biggest challenges arresting expansion of the Indian auto sector,” reasoned Wadhera.

Nonetheless, not all is doom and gloom. The figures for December 2019 Show the rate of sales decline has slowed down. Demand for passenger cars is slowly advancing, SUVs are firing on all cylinders and LCVs are currently doing better than six months ago. In constructing infrastructure such as roads, with the government Rs lakh crore investment, it’s felt the CV industry should benefit to some degree. All OEMs also have started rolling out BS VI-compliant products and are actively engaged in the upgrade. Sales will be undoubtedly impacted by the price mark-up but it is felt that demand is very likely to come back by the season. Till then, the industry will probably ride a line that is tough, balancing generation and stock at dealers.

Captains of industry have been Anticipating a cut in the GST on automobiles, a movement that will help renew demand and spur growth. Likewise, it is believed that a Motor Vehicle will be introduced by the government once the BS-VI mandate kicks in on April 1, this season scrappage policy.