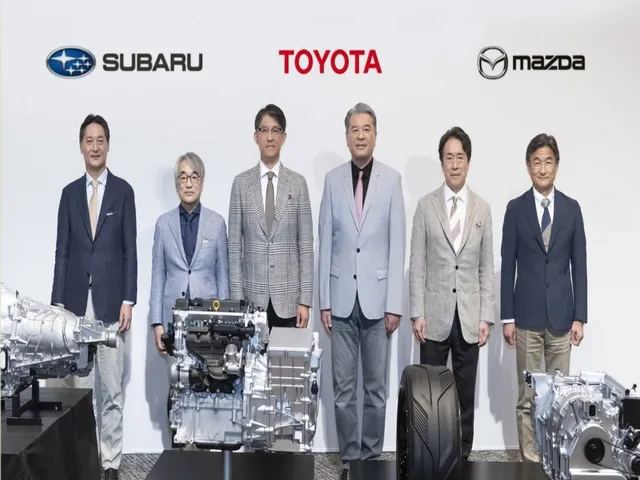

Toyota, Subaru and Mazda are three major Japanese automakers that have collaborated on new advanced powertrain technology. At a joint press event this week, these companies revealed they are developing the next generation of gasoline engines.

Their approach aims to make internal combustion engines more efficient and eco-friendlier for years to come. This article will share key details about the automakers’ innovative new engines and their shared goal of reducing emissions.

Toyota, Subaru, and Mazda Announce Game-Changing Engines

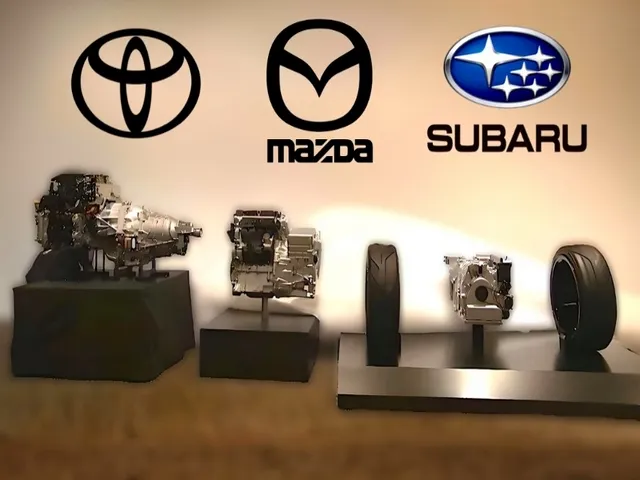

At the conference, executives from Toyota, Subaru and Mazda demonstrated prototypes of new engines they are currently working on. Toyota is focused on creating two improved 4-cylinder engines, one with a 1.5 liter displacement and another with 2.0 liters.

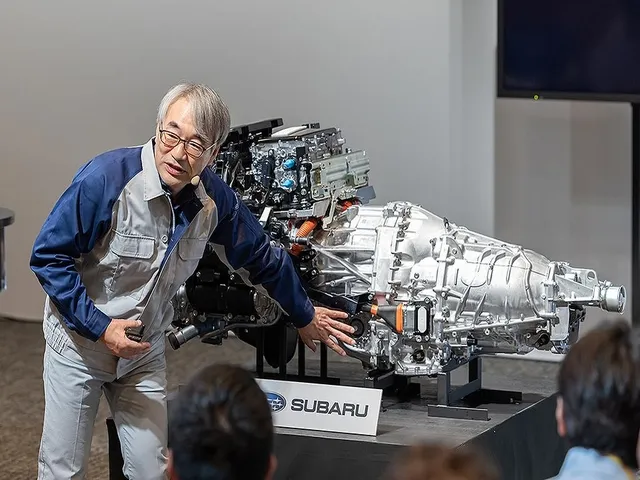

Mazda is developing advanced rotary engines that can include either one or two rotor components. Subaru is focused on enhancing its trademark boxed engines with hybrid technology.

All three companies emphasized these new powertrains will utilize up to 10% less volume and weight compared to earlier engines. The automakers said this downsizing will allow more functional integration with electric motors and batteries in hybrid electric vehicles.

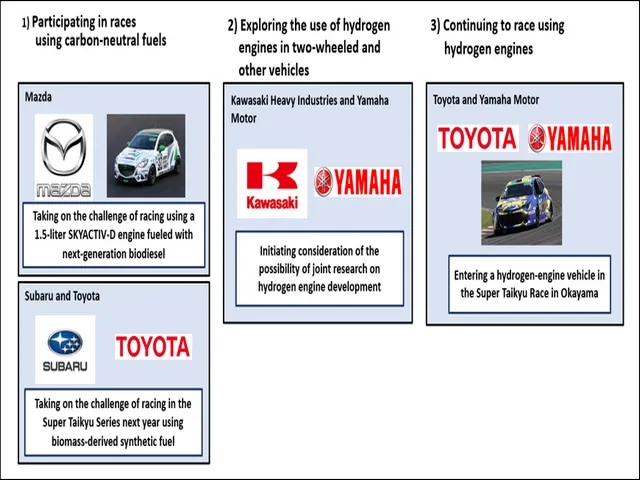

The 1.5 liter Toyota engine is expected to achieve a 10% reduction in size compared to existing 1.5 liter models. In addition, Toyota, Subaru and Mazda stressed their new engines will be optimized to run on various low-carbon fuels.

This includes renewable biomass fuels, synthetic e-fuels produced from captured carbon dioxide, and liquid hydrogen sourced from renewable energy electrolysis. Being compatible with different fuel types will help reduce emissions over the engine’s lifespan.

The automakers expect their redesigned engines to enable new vehicle architectures with lower hood heights and improved aerodynamic designs.

The more compact size is intended to boost performance and fuel efficiency further. All three companies will work to finish prototype testing and evaluate mass production plans within the next 5 years.

Their collaboration aims to develop an integrated powertrain design that combines each brand’s signature engines with electric vehicle technology.

The shared goal is reducing environmental impact while preserving the important role internal combustion will continue to play. The new engines may boost the automakers’ efforts to comply with progressively tighter global emissions regulations.

Innovative Combustion Engines Compatible with Alternative Fuels

Toyota, Mazda, and Subaru revealed that the new engines will aim to be 10% smaller and lighter than current engines. The 1.5 liter Toyota engine will see a 10% reduction in size compared to existing 1.5 liter models.

These new engines will have improved compatibility with alternative carbon-neutral fuels like biofuels, e-fuels and liquid hydrogen. Each of these fuels emit lesser or no CO2 when consumed in the engines.

Being compatible with different fuel types will help reduce emissions over the long run. The automakers emphasized that developing engines optimized to use diverse carbon-neutral fuels can significantly help lower overall emissions from vehicles.

The new engines are expected to enable the use of up to 30% of such alternative fuels. This would directly cut up to 30% of CO2 emissions from the tailpipes. The companies plan to collaborate closely to develop these new powertrains that can be used with different fuel and power alternatives depending on the needs.

The Potential of Hybrid Vehicles in Mainstream Adoption

Last quarter, Toyota sold around 2.4 million vehicles worldwide, out of which nearly 40% were hybrids that came petrol-electric powertrains.

Hybrid vehicles offer the benefit of both technologies by giving a boost during acceleration from the electric motor and improving fuel efficiency via regenerative braking.

As consumer demand and awareness around sustainability increases, hybrid cars are appealing to more buyers. Recent industry data also shows hybrid vehicles registrations growing faster than electric vehicles in major markets.

Their sales growth highlight consumers growing interest in environment-friendly vehicles that still offer long driving range and quick refueling over electric vehicles.

As automakers continue advancing hybrid technology with smaller and better performing engines and battery systems, their uptick in the market is likely to continue.

This rapid uptake of hybrids shows they can become mainstream and act as a steppingstone until electric vehicles become more affordable.

Recent Slowdown in the EV Market Raises Significant Questions

The electric vehicle market has experienced notable growth over the past few years. However, sales have declined by around 13% in the past year for major manufacturers.

Around 23% of public fast chargers in major cities like San Francisco also did not work in 2022. This slowdown has no doubt raised questions about whether EVs can truly achieve mass adoption. Consumer demand has also relatively flattened compared to initial hype.

Issues around range and reliability of public charging remain significant barriers. With battery costs still making EVs around 30% more expensive on average, many buyers remain hesitant.

The slowing sales growth suggests more improvements are needed to convince mainstream buyers. Further data shows that hybrid vehicle registrations in areas like Europe have surpassed EVs in 2022 after years of being behind.

This highlights that many buyers still prefer hybrids that combine fuel efficiency with the range and refueling convenience of gas vehicles.

As the current limitations of EVs become more clear, major targets for the shift away from gasoline may need revising. Automakers need to focus on making EVs genuinely competitive with gasoline alternatives on price and practicality before strong bans are put in place.

Winners and Losers Amid New Automotive Innovations

The introduction of new combustion engine and fuel cell technologies has the potential to disrupt the current dynamics in the auto industry. Automakers taking a diversified approach like Toyota that invest in multiple solutions may be best positioned to adapt.

However, companies solely focused on large-scale EV production likely face challenges if affordable synthetic fuels and hydrogen gain ground in the coming years.

Tesla as the current EV sales leader may be at a 56% risk if alternatives eliminate its differentiation, while startups` lack of flexible manufacturing could constrain their ability to transition.

On the other hand, automotive suppliers involved in fuel cells, batteries for hybrids and EVs as well as companies developing e-fuels could see increased opportunities.

This includes major players like Chart Industries, Plug Power and others. Traditional automakers may also gain versus pure EV brands by leveraging existing plants and workforce more easily.

Governments and regulators may need to carefully consider diverse pathways to decarbonization that balance environmental and economic factors. A prudent approach balancing various technologies could help expedite the shift.

The Future of Automotive Technology

Toyota, Mazda and Subaru have partnered together to develop the next generation of combustion engines that would make up 30% of the market, according to estimates.

This partnership aims to refine their signature engines to make them 13% more efficient and 10% smaller in size. The automakers claim that these advancements will allow them to design vehicles with aerodynamic improvements of around 7%.

Furthermore, the compatibility of these engines with alternative carbon-neutral fuels like biofuels and synthetic fuels would help cut CO2 emissions by 20% compared to current gasoline vehicles.

However, many believe that full electrification is the ultimate solution to emissions problems. But the automakers highlight that battery supplies are only meeting 56% of demand and costs still make EVs 23% more expensive than gasoline vehicles.

This collaboration will hopefully help them bridge the gap between current technologies and full electrification which many estimates may be achieved around 2035 at the earliest based on current trends.

Final Words

Toyota, Subaru and Mazda are betting that the future of personal transport will involve multiple solutions instead of just one. Their focus on keeping combustion engines relevant through innovative engineering makes strategic sense.

Of course, it remains to be seen just how much these new engines can ultimately lower emissions. A lot will depend on what specific fuels they run and how cleanly those fuels are produced.

Overall it is evident the automakers are not giving up on internal combustion without a good fight. And who could blame them as the infrastructure is still lacking in many places.

If they succeed in significantly extending the life of gasoline engines through these collaborative efforts, it might prove decisive for their bottom lines over the next crucial decade in autos. Only time will tell how impactful this multipath approach can be.