Domestic demand remained concentrated in passenger vehicles and compact segments during the year. Manufacturers maintained disciplined inventory levels, while financing conditions stayed relatively stable.

Nissan continued to lead national sales volumes, supported by broad dealership coverage. Other global brands also reported steady gains, although growth rates varied across regions.

Electric and Hybrid Vehicles Gain Market Share

Electric and hybrid vehicles reached 9.5% of total Mexico auto sales during 2025. This share represented one of every ten vehicles sold nationwide across all light segments. Industry data showed higher availability of hybrid models across price ranges.

Consumers also favored lower fuel costs and extended driving range options. The growth reflected manufacturer strategies rather than rapid full electric adoption patterns.

Furthermore, Hybrid vehicles accounted for most alternative technology sales across urban markets. Charging infrastructure development remained uneven across regions and income groups. As a result, automakers continued to prioritize mixed technology portfolios for Mexico.

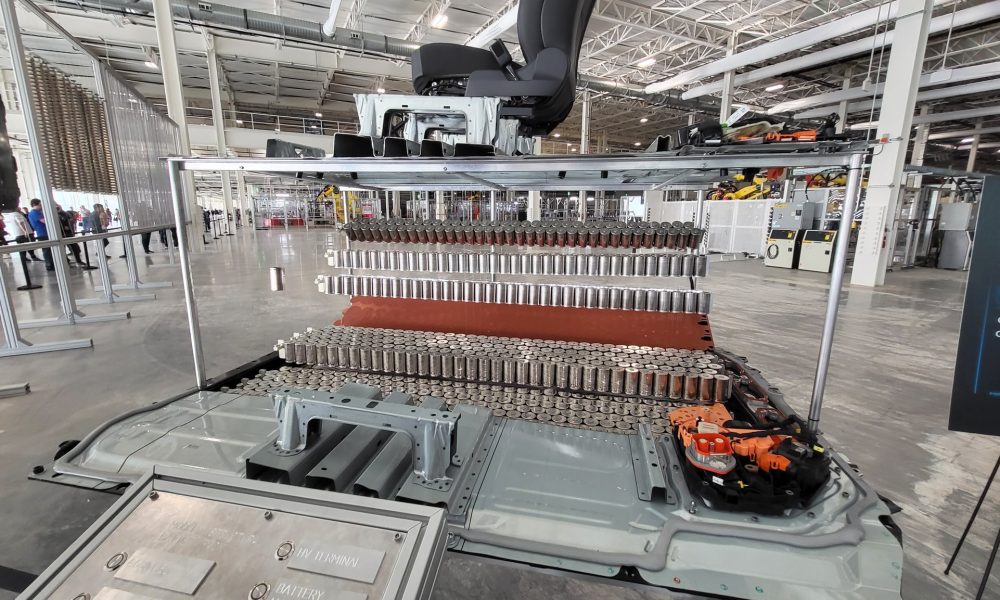

Lithium Policy and EV Battery Production Remain Absent

Mexico has not produced electric vehicle batteries nearly three years after lithium nationalization. The policy aimed to reserve lithium resources for state use and domestic industrial development.

However, no commercial battery plants have entered production since the decree. Automotive supply chains have not integrated domestic lithium into current manufacturing plans. Industry sources noted delays in project approvals and limited technical partnerships.

Battery investment requires long timelines and stable regulatory frameworks for global firms. Automakers therefore continue sourcing batteries from established international suppliers. This situation keeps Mexico dependent on imported battery systems for electric vehicles.

Global Automakers Reshape Competitive Landscape

Chinese automakers are expected to surpass Japanese groups in global vehicle sales during 2025. Data estimates show Chinese brands nearing 27 million units sold worldwide. Japanese manufacturers are projected to remain below 25 million units.

Electric vehicle leadership and export growth supported Chinese expansion. Hyundai Motor also closed 2025 with 4.14 million global vehicle sales. The group recorded its strongest annual sales performance in the United States market.

These results reflected product renewal cycles and steady demand for utility vehicles. Global competition therefore continues influencing production and sales strategies across Mexico.